Creating an RFM model

Overview

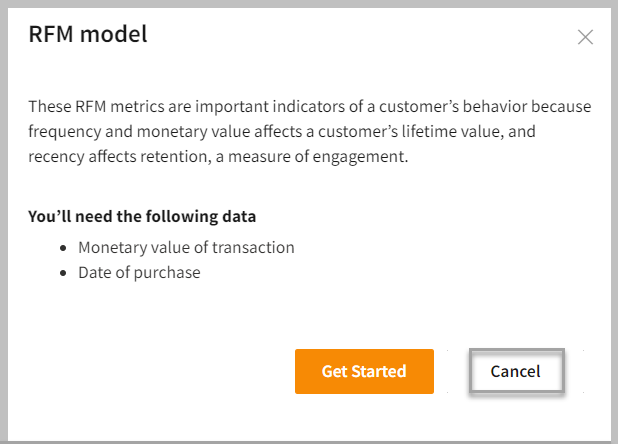

RFM is a segmentation strategy that uses historical transactional data to segment customers based on three variables: Recency (R), Frequency (F), and Monetary value (M). These RFM metrics are important indicators of a customer’s behavior because the frequency and monetary value affect a customer’s lifetime value, and recency affects retention, a measure of engagement. These are as follows:

- Recency - Days since the customer last made a purchase.

- Frequency - Number of unique dates on which a purchase is made.

- Monetary Value - Total sales amount for this period.

With the Skypoint AI-powered RFM model, you can rank and group customers based on the recency, frequency, and monetary value of their recent transactions to identify the best customers and perform targeted marketing campaigns.

Prerequisite

To create an RFM model, you must have an existing timeline journey with the following data:

- MDM configuration

- Monetary value

- Date of purchase

To create an RFM model

Follow the below steps to create an RFM model:

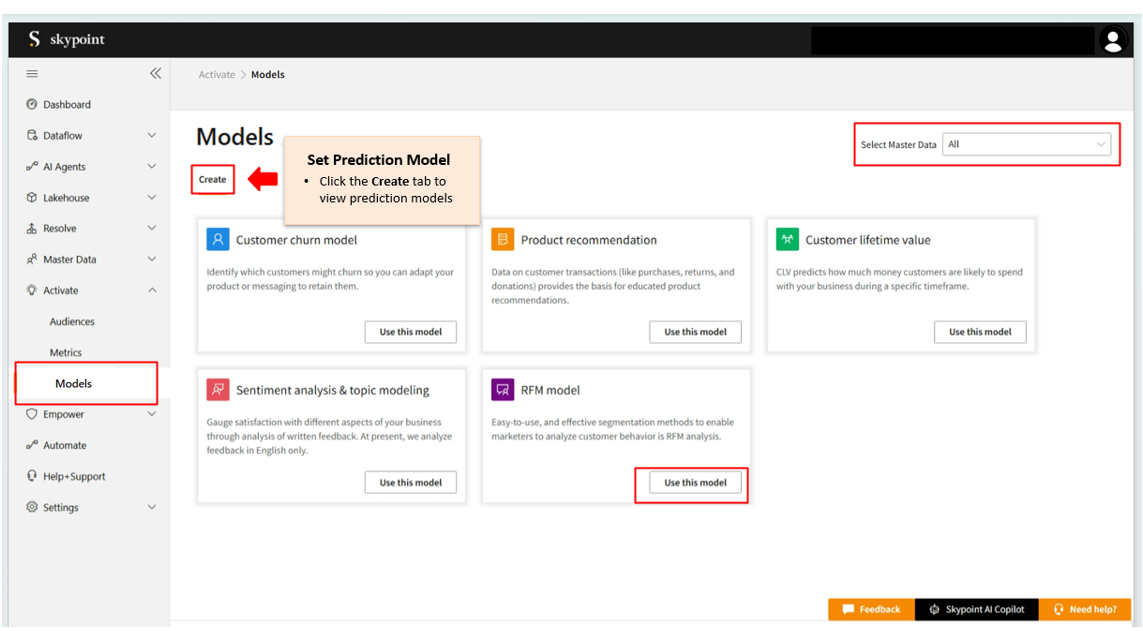

- Go to Activate > Models.

The Models page appears.

- Open the Create tab.

- Select Master Data from the dropdown list. When you select the master data, the system validates the selected master data type and filters the predictions based on the selection.

- Click Use this model under the RFM model.

- Select Get Started.

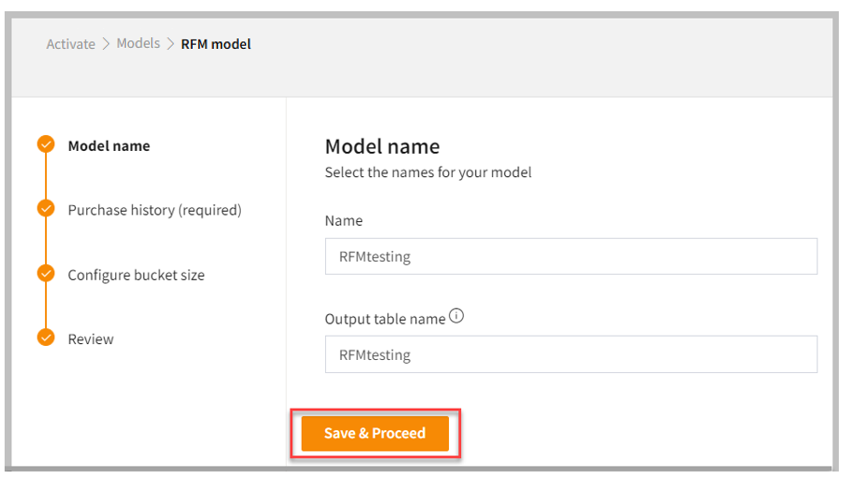

Step 1: Create a model name

Follow the below steps to create a model name:

- Enter the Name and Output table name for your model. The output table name appears on the database page after running your model. It includes letters and numbers only, without any spaces.

- Click Save & Proceed.

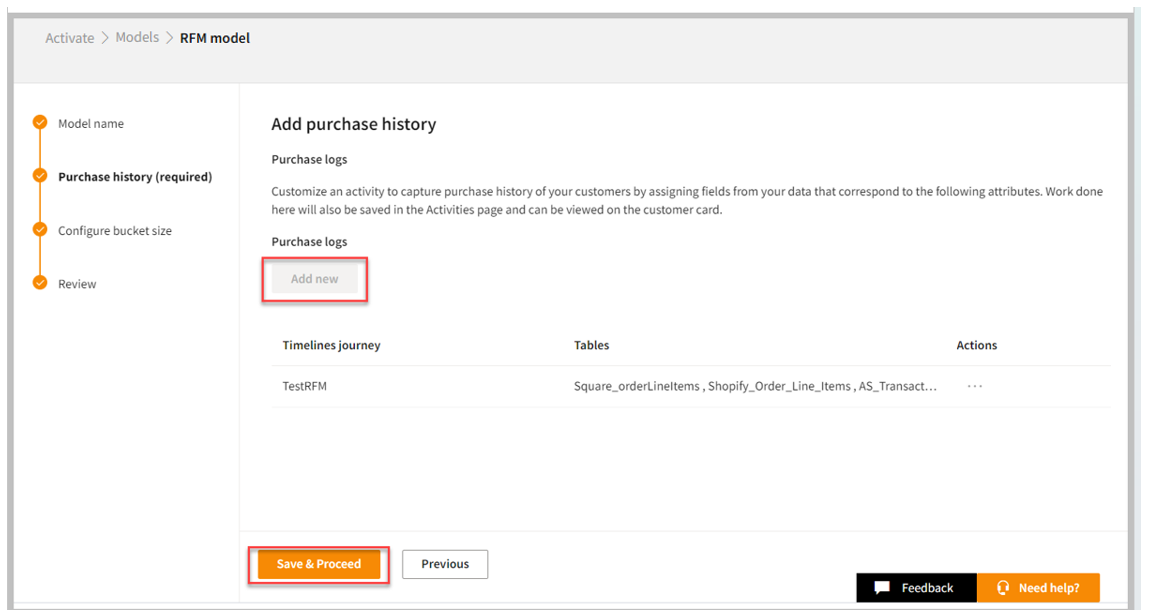

Step 2: Add purchase history

Once you have saved the name and output table name, Add purchase history page appears to capture the purchase history of your customers.

Follow the below steps to add purchase history:

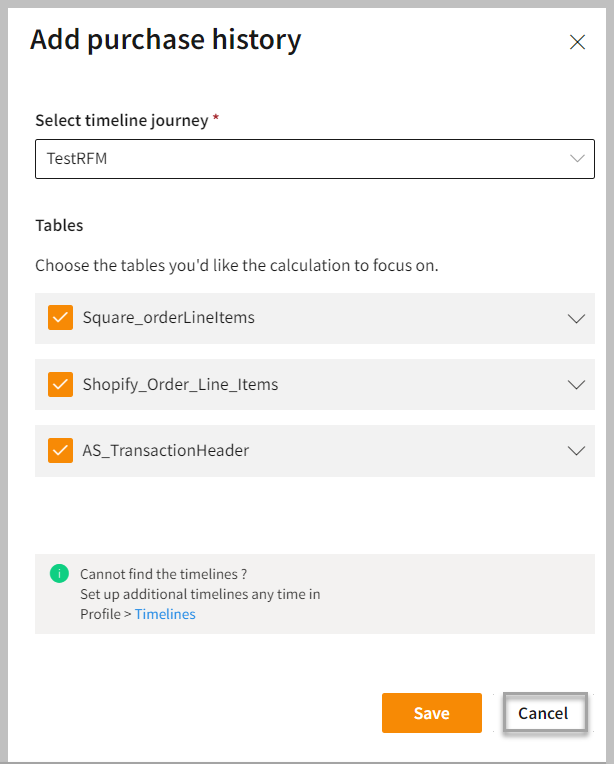

- Click Add new to add timelines journey.

- Select timeline journey from the dropdown list.

- Expand tables and select the monetary value of the transaction.

- Click Save to apply your changes.

Once you have added a purchase history, it will show under the Timelines journey.

- Click Save & Proceed.

Step 3: Configure your bucket size

Follow the below steps to configure the bucket size for your RFM model:

- Go to Configure bucket size page. You have two options to configure the model as follows:

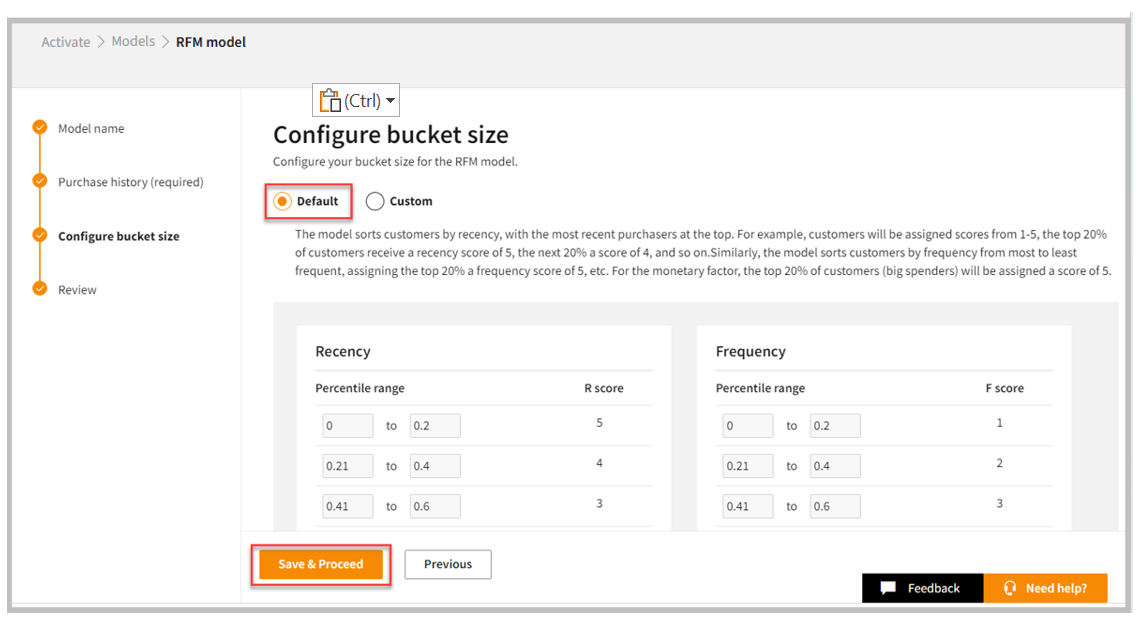

Default

In the Default bucket, the system automatically groups the entire data set into 5 buckets of 20 percentile each.

- Select the Default button.

The RFM model ranks a customer in each of these three categories on a scale of 1 to 5 (the higher the number, the better the result). The RFM model sorts customers by recency, with the most recent purchasers at the top. For example, customers will be assigned scores from 1-5, the top 20% of customers (recent purchasers) receive a recency score of 5, the next 20% a score of 4, and so on. Similarly, the model sorts customers by frequency from most to least frequent, assigning the top 20% a frequency score of 5. For the monetary factor, the top 20% of customers (big spenders) will be assigned a score of 5.

- Click Save & Proceed.

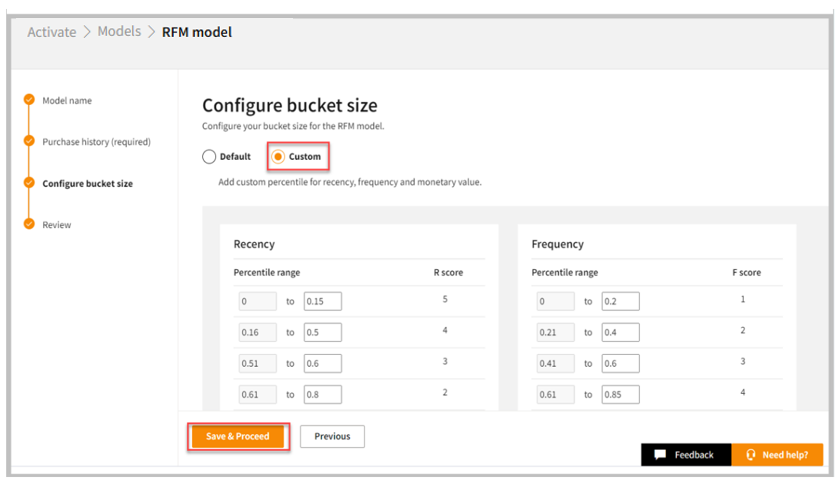

Custom

A custom RFM model is personalized to the specific needs and goals of a business. It involves modifying the criteria used to calculate the scores for each variable, or weighing the variables differently based on the importance of each to the business. For example, a business that relies heavily on repeat customers may want to give a higher weight to the Frequency variable in its RFM model, while a business that focuses on high-value transactions may want to give a higher weight to the Monetary value variable.

Customizing the RFM model allows a business to better understand its customer base and target its marketing efforts more effectively.

In the Custom bucket, you can customize the percentile range for recency, frequency, and monetary value.

- Select the Custom button.

- Modify the percentile range for your RFM model.

- Click Save & Proceed.

RFM factors illustrate these facts:

- The more recent the purchase, the more responsive the customer is to promotions (the more recent purchases - the higher the R score).

- The more frequently the customer buys, the more engaged and satisfied they are (the more frequently purchase - the higher the F score).

- The monetary value differentiates heavy spenders from low-value purchasers (the more amount spent - the higher the M score).

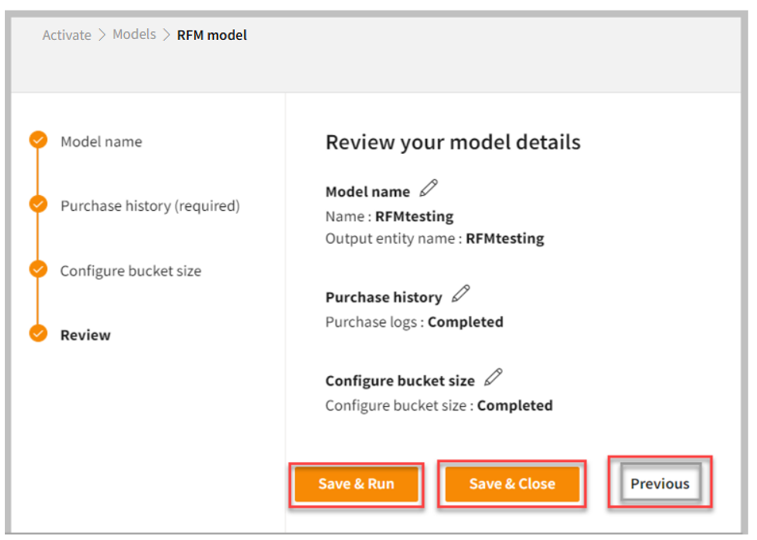

Step 4: Review and run your model

Once you have configured the bucket size of your RFM model, you can review your model details.

- You can modify the previous steps on the Review your model details page. Click the Edit icon to update it.

- Do one of the following:

| To | Do |

|---|---|

| Save and run your RFM model | Click Save & Run. |

| Save and close your RFM model | Click Save & Close. |

| Open previous step | Click Previous. |

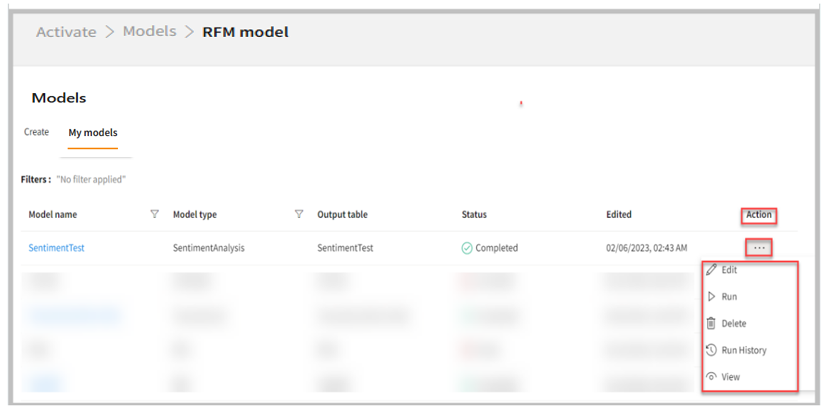

- Go to the My models tab to view your RFM model.

- If necessary, select the horizontal ellipsis under the Action column and do the following:

| If you want to | Then |

|---|---|

| Modify the RFM model | Select Edit and modify the RFM model. |

| Execute the RFM model | Select Run. |

| Remove the RFM model | Select Delete. |

| See the run history of the RFM model | Select Run History. |

| View the RFM model | Select View. |

The RFM table is displayed in the Gold tab under Lakehouse > explorer. Select the table and click the Data tab to view the RFM score (recency, frequency, and monetary).